The Indonesia animal feed market for continues to expand because of quick urbanization changes together with mounting protein consumption and fast-growing livestock industries. The Southeast Asian country of Indonesia maintains a continuously expanding market for meat products together with poultry items and eggs and dairy products due to its large and growing population. The animal feed market demand leads to innovations in feed production while manufacturers expand their capacity and boost foreign investment in Indonesian agribusiness operations.

Indonesia Animal Feed Market Overview

The feed manufacturing sector in Indonesia stands as one of the most extensive in Southeast Asia because it provides nourishment for all major animal farming operations such as poultry and ruminants and aquaculture and the swine sector. The food consumption of poultry surpasses all other animals because it represents more than 60% of animal feed usage throughout the country.

The market operates through imported raw materials consisting mainly of soybean meal together with corn and fishmeal. Active initiatives aim to develop homegrown feed ingredients as well as domestic feed additives to decrease foreign dependence in animal nutrition and enhance food security.

Key Drivers of Growth

The middle class expansion together with increased protein consumption has driven market expansion.

The rising middle class in Indonesia now chooses dietary plans with higher amounts of protein. The steady growth of chicken and fish and beef consumption in Indonesia keeps driving up animal feed market demand across all product segments.

Poultry Industry Expansion:

Current statistics indicate that the commercial broiler and layer poultry business sector is expanding rapidly. Integrated poultry companies establish vertical control in their business operations through hatcheries to feed mills to meat processing which results in steady market requirements for high-quality feed.

Aquaculture Boom:

The substantial coastline of Indonesia allows the nation to sustain its flourishing aquaculture operations which focus mainly on raising shrimp alongside tilapia and catfish. Food producers within aquaculture business sectors investigate new manufacturing methods to enhance both feed conversion ratios and water quality sustainability standards.

Government Support for Livestock and Feed Development:

The Feed Security Program launched by government authorities seeks to improve local feed production through multiple measures that support feedmill updates and strategic feed crop developments. The long-term market resilience depends heavily on governmental policies which offer essential support.

Technology and R&D Investment:

The international feed manufacturing sector in Indonesia implements contemporary feed technology solutions like enzyme blend systems and organic acid applications and precise nutritional tools which enhance both livestock functionality and health performance.

Key Challenges

Import Dependence and Price Volatility:

Feed ingredients for the country must be obtained from imports because of extensive dependence. Global commodity price changes together with currency value reduction and delivery-related issues create major disruptions in feed production expenses and profitability levels.

Infrastructure and Distribution Constraints:

The shortage of cold chain facilities together with feed distribution limitations in both rural areas and islands creates feed availability issues and weakens quality control and delivery speed particularly for aquaculture and small-scale livestock farmers.

Regulatory and Quality Control Gaps:

Regulations for feed exist throughout Indonesia but provincial authorities differ in their enforcement levels. The market occasionally conducts unauthorized entry of false or inferior animal feed items which threatens both livestock health and farmer confidence.

Smallholder Fragmentation:

A large majority of Indonesian livestock farmers operate as small-scale producers lacking suitable feed products and animal nutritional best practices. The market becomes divided because different areas have inconsistent product quality.

Future Opportunities

Domestic Ingredient Development:

The interest in developing local corn, cassava and soybean meal production steadily grows as an approach to boost feed independence. The adoption of new methods to process palm kernel meal and copra meal alongside using insect protein represents current emerging developments.

Sustainable Feed for Aquaculture:

The Indonesian aquafeed industry invests in algae-based and microbial and plant-based feed alternatives to develop environmentally sustainable feed options because fishmeal concerns are growing at a global level.

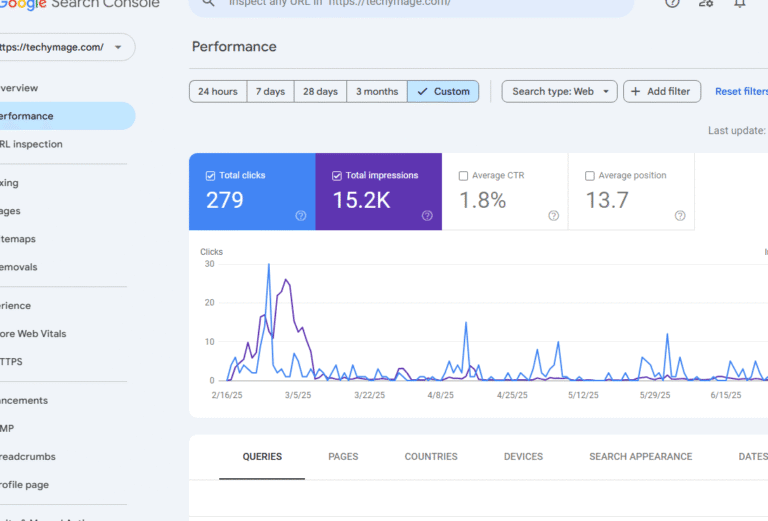

Read more contnet at techymage.com