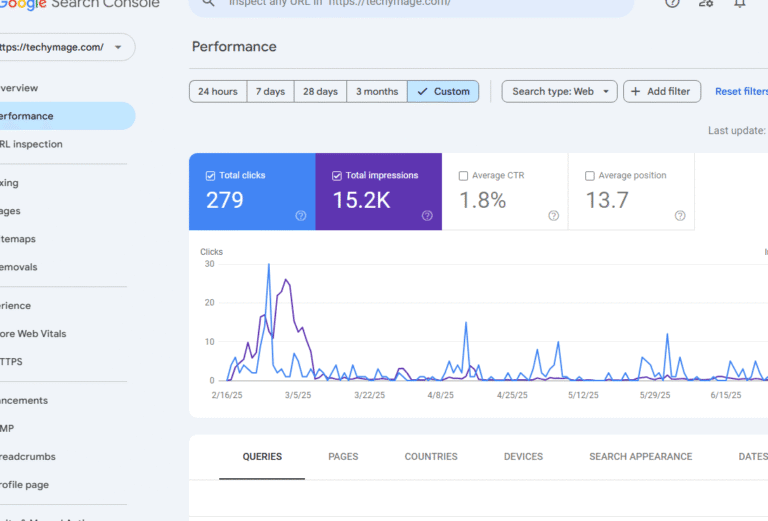

If a platform’s results are accurate, this means the analysis and prediction of that platform are on point. In simple words, the accuracy of an AI trading platform can be assessed by its overall performance. If the overall performance of a platform is good, that platform is reliable. But how is the accuracy of the trading platform reviewed?

AI trading platforms perform their analysis and market trend predictions using AI technology. In this article, we will learn, ‘How accurate are AI Traders in predicting market trends?’. Also, we will explore the AI Traders accuracy in predicting stock market trends 2025. How reliable are AI algorithms for forecasting market movements?

If the market analysis and price prediction are correct, it means the platform tools have high accuracy. The accurate results help traders in making exact predictions. With the right trades at the right time, traders can earn good profits. Is there any platform that offers accuracy through market price and trend predictions? Yes, AI Trader platforms use advanced algorithms and machine learning techniques. These help them achieve the exact results they expect. Let’s take a deep dive and find answers to all the questions!

AI Traders Accuracy in Predicting Stock Market Trends 2025:

AI systems like AI Trader provide real-time insights into stock market movements by processing the data. However, their reliability varies based on different factors. The quality and quantity of data that is used for training affects the accuracy. Also, the market dynamics, complexity, and unexpected events impact it.

AI models sometimes struggle with extreme market conditions or unexpected events. To enhance reliability, perform continuous strategy adjustments and ensure advanced risk management. Also, you can make considerations of broader economic factors. However, it is important to view AI predictions as tools for analysis.

Human judgment, market understanding, and a diversified approach are essential. You can easily navigate the complexities of stock market investing. AI Traders can provide comprehensive market analysis and news. Moreover, it offers educational materials to make traders learn.

AI is much faster and better at studying large amounts of data. It helps traders make smart and quick decisions. It uses past and present data to predict future market moves. It checks stock prices, news, and other information to find clues about the market. This helps traders make better decisions and hopefully earn more profit.

With old market data, it tries to spot patterns that have occurred before. It finds economic facts using that data like interest rates and inflation. The news and sentiment analysis helps it in learning what people are thinking about the market. The company reports like profits and losses also help in predicting future stock market trends. AI can detect small details humans might miss.

How Reliable are AI Algorithms for Forecasting Market Movements?

One of the most important features of Artificial Intelligence for trading is its ability to examine historical market data on a large scale in a few seconds. With this speed, it forecasts future market movements. In simple words, it processes large datasets so AI models can predict how stocks might perform based on past market behavior.

AI algorithms are more reliable than old methods because they work on real-time data. They have the ability to learn from past events. In this way, when a pattern is about to repeat in the market, AI algorithms send alerts to traders to inform them. Using these alerts, they can make better trading decisions on the spot.

Advanced AI algorithms like machine learning, predictive analytics, and deep learning are reliable because they keep learning from their mistakes and past experiences. They can copy the successful trades of other investors. They can adjust the trading strategies on the run time during live trades. This helps in locking trades in profits as well as eliminating sudden risks.

AI algorithms do not possess any sort of feelings or emotions. They work on logic, calculations, experiences, and market data. So, this reduces the decisions driven by emotions like greed or fear.

Effectiveness of AI Trading Systems in Predicting Financial Markets

AI trading systems greatly improve the way financial markets are analyzed and predicted. These advanced tools process large volumes of market data to uncover patterns and trends. These might be missed by human traders. This leads to greater accuracy in forecasts.

By automating tasks like data processing and trade execution, AI increases overall efficiency. It saves time and allows traders to concentrate on strategic decisions. Furthermore, Artificial Intelligence helps identify possible risks and profitable opportunities. This supports better risk management and safer investment choices.

With the ability to examine diverse market factors and suggest the best asset combinations, AI enhances portfolio optimization. A strong trading portfolio helps traders achieve their financial goals. So, integrating AI into trading strategies boosts accuracy and efficiency. Also, it provides risk control which results in more informed and successful trading outcomes.

Conclusion

In short, AI is changing the way people trade in the stock market. It has made things faster, smarter, and easier. AI traders study huge amounts of data to find patterns and predict what might happen next. They help traders make better decisions by giving accurate market insights and alerts.

While AI is very helpful and reliable, it is not always perfect because unexpected events can still affect the market. That is why it is important to use AI tools along with human knowledge and smart strategies. When used properly, AI can improve trading results, manage risks, and help traders reach their financial goals with more confidence.

Visit TechyMage for more informative blogs