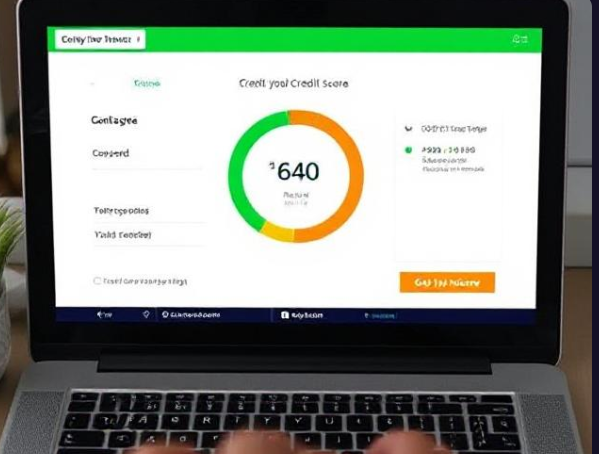

Gomyfinance: Optimize Your Financial Life. com Credit Score

Give Your Credit Score Some TLC Your credit score A number on a piece of paper A fundamentally essential number on a piece of paper It is telling the world exactly how responsible you are when it comes to borrowing and paying back money. Be it a loan, an apartment or a mortgage you’re after, the credit score is what lenders use to gauge your creditworthiness. Gomyfinance.com detailed credit score analysis to help you make smarter financial decisions.

What is a Credit Score?

A credit score is a three-digit number, typically ranging from 300 to 850, that represents your creditworthiness. It is calculated based on several key factors, including:

- Payment History (35%) – Consistently making on-time payments boosts your score.

- Credit Utilization (30%) – Using less than 30% of your available credit improves your rating.

- Length of Credit History (15%) – Older credit accounts positively impact your score.

- Credit Mix (10%) – A variety of credit types, such as loans and credit cards, enhance your score.

- New Credit Inquiries (10%) – Multiple recent credit applications can negatively affect your score.

The Reasons Your Gomyfinance.com Credit Rating Is Important

Your credit score is vital for:

Better loan conditions result from higher scores, hence qualifying for loans at low interest rates.

Credit Card Approval: A high rating improves your chances of premium credit card approval.

Landlords run credit checks on prospective renters before approving housing and apartments.

Negotiating Insurance Rates

Building Economic Stability Better financial possibilities are available to you thanks to a good credit score.

How to Raise Your Gomyfinance.com Credit Score

Raise your credit score and follow these actionable steps:

1. Always Pay Your Bills on Time

You do not want to be late or you will negatively affect your score. set up reminders or automate payments to make sure your bills are paid on time.

2. Lower or Reduce Credit Utilization

You want to use less than 30% of your available limit on credit cards. So pay what’s outstanding and keep your credit utilization rate as low as possible.

3. Monitor Your Credit Score frequently

Monitoring your Gomyfinance.com credit score frequently can also help you identify issues or fraud before tragedy strikes. If your credit score is being negatively impacted by an error or misuse from your credit provider, you will want to dispute those errors as soon as possible before your credit score is negatively affected.

4. Avoid Hard inquiries

Applying for multiple forms of credit when the inquiries occur too close together can also adversely impact your credit score. If you need to apply for credit, only do so if you have valid reasons to apply.

5. Different Types of Credit

Although having different types of credit (credit cards, installment loans, mortgages, etc.) will have no impact on your credit score at the time the accounts are opened, eventually, over time, having different types of credit can have a positive impact on your credit score.

Benefits of Checking Your Gomyfinance.com Credit Report

Early Fraud Detection – Catch undesirable activity before it affects your credit health.

Better Loan Opportunities – The higher your score the better rates and loan terms you can receive.

Informed Financial Goals – Knowing your credit score gives you an value of what goals are realistic to set.

Faster Approval for Loans and Credit cards – Having a great credit score could have the potential to hasten the approval process!

Frequently Asked Questions

How Often Should I Check My Credit Score?

It’s recommended to check your credit score at least once a month to stay informed and make necessary adjustments.

Does Checking My Credit Score Decrease It?

No. A soft inquiry is when you check your own credit score and will not impact your score.

How Much Time Does It Take to Improve My Credit Score?

There are various things that can impact it, but if you have good habits financially, in a matter of months, you will notice improvements.

Take Control of Your Financial Future

Your Gomyfinance.com credit score is a major determinant of financial success. By learning how it’s calculated and practicing good credit habits, you can build your score and open up improved financial opportunities. Begin monitoring your credit score today and take control of your financial future!